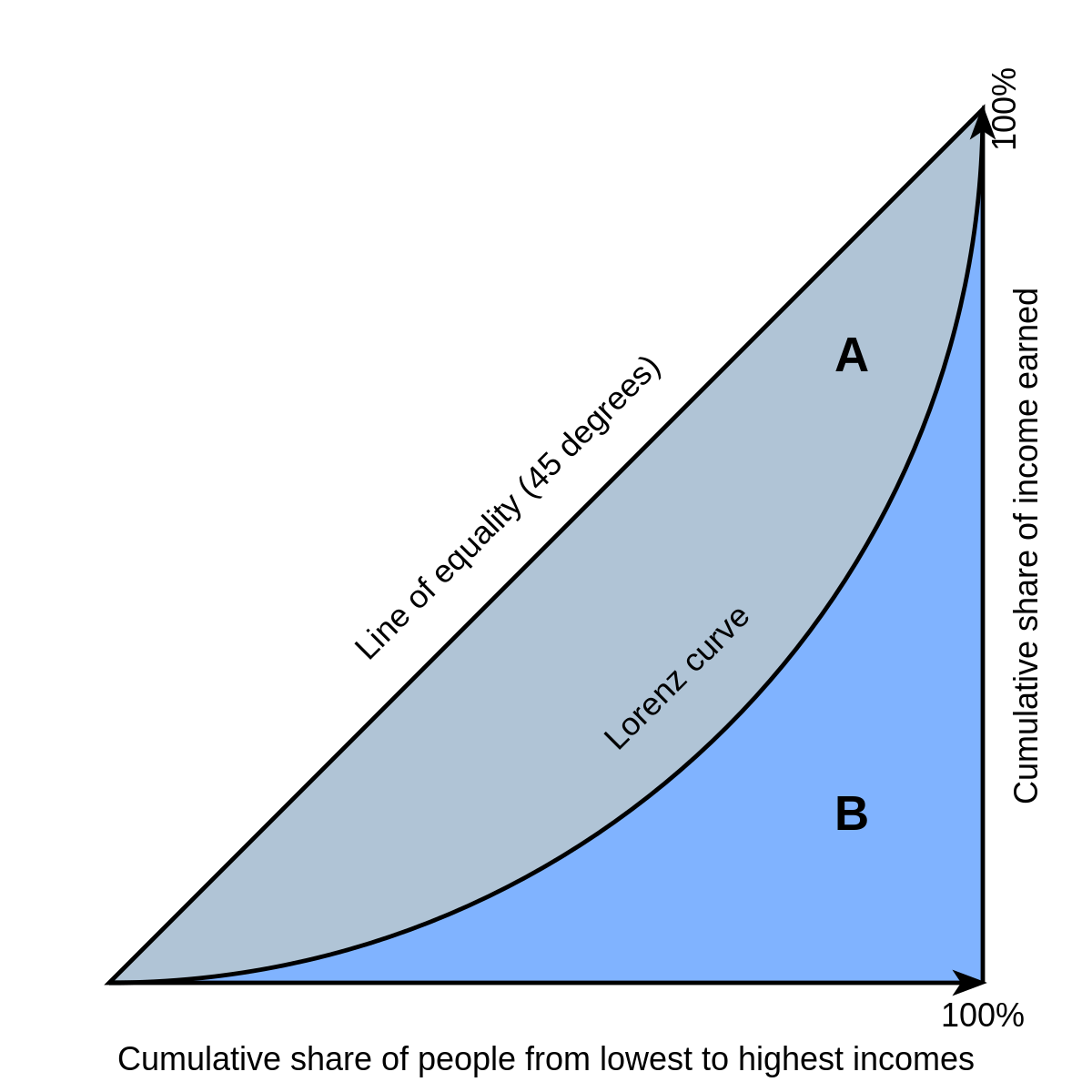

Lorenz Curve and Gini Coefficient

The Lorenz Curve illustrates the distribution of incomes in a country. The Line of Equality represents a country where there is perfect equality - each member would receive the exact same income. The closer the Lorenz Curve is to the Line of Equality, the higher the income equality of that country. The further away from the Line of Equality, the lower the income equality.

The Gini Coefficient indicates how unequal a society is. It indicates how far the Lorenz Curve is from the Line of Equality. It is good for comparing several countries to one another as it is quantitative, but doesn't give as much information as the Lorenz curve does, as it leaves out the distribution of income. It is calculated using the above formula.

G = A/A+B

It always lies between 0 to 1, where 0 is perfect equality, where everyone gets the same amount, and 1 is perfect inequality, where one person has all the income and everyone else gets nothing.

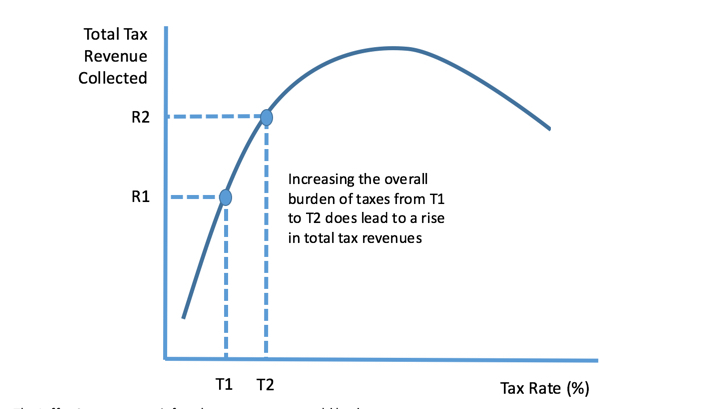

Laffer curve

The Laffer Curve depicts the relationship between rates of taxation and the revenue the government receives in tax. It is a parabola, because past a certain point, higher taxation rates means that there is a lack of incentive to work more, as you are not receiving much of the money you have worked for. Therefore people work less, or find a way to evade high taxes, and there for the government collects less money in tax, leading to the downwards slope.

Tax is one solution to inequality - it redistributes income within a population.

Comments

Post a Comment