Efficiency

Allocative efficiency

Output at which the marginal utility, or benefit, of a good to a consumer is the same as equal to the marginal cost of producing it.

This is seen on demand/supply curves, where D = S, output is produced as demand = marginal utility and supply = the sum of firms' marginal costs in an industry. On an individual scale, it is where:

AR = MC

Output is where the demand curve cuts the MC curve.

NB: technically occurs where MSB = MSC (if you consider externalities)

Occurs in perfect competition.

Eval - PC markets achieve allocative efficiency where there are no externalities. LR equilibrium is where P = MPC, so if MSC > MPC, then there is an allocative inefficiency which leads to overproduction and consumption.

Productive efficiency

Output at which a good is produced at the lowest possible average cost for a firm. This occurs at the minimum point of the AC curve.

AC = MC at this point, because when the marginal is below the average it brings it down and vice versa, so when the marginal cuts the average its gradient is zero and it is at a minimum.

Dynamic efficiency

Efficiency over time, associated with innovation and technological progress. Happens when firms carry out R&D and invest in new tech and training. Hard for firms in a perfectly competitive market structure to achieve this due having no supernormal profits to reinvest.

Economist Joseph Schumpeter used dynamic efficiency as an argument for monopolies.

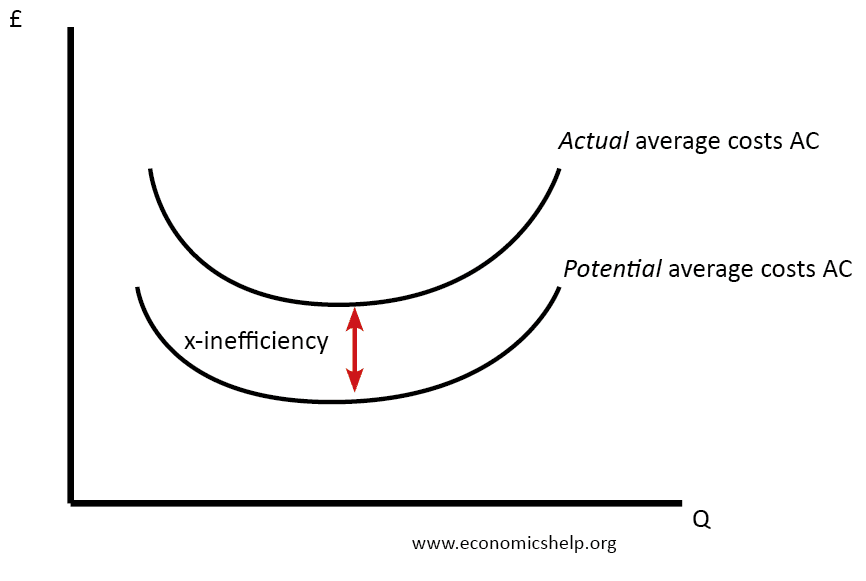

X-inefficiency

When a firm is not operating at minimum cost, often due to 'organisational slack'. This could be due to the principal-agent problem, or in a monopoly market structure the firm not having competitive pressure on it to keep costs at a minimum.

Comments

Post a Comment